How To Avoid Alimony In Massachusetts

Put an end date on alimony payments. Alimony payments do not have to be a lifelong affair.

14.2k Likes, 97 Comments Sara Kuburic, MA, CCC

J.b., a divorce case decided by the massachusetts appeals court and ruled on march 17, 2020.in this case, the parties made an agreement before the final entry of their divorce and the appellate court ruled that this agreement should stand, resulting in a.

How to avoid alimony in massachusetts. How to avoid alimony in massachusetts you’re facing divorce. The thought of having to sacrifice some of your pay regularly produces fear and panic in most. Temporary alimony agreements made during a pending divorce will be enforced.

You’ve sacrificed blood, sweat, and tears to boost your family financially. For a divorce or separation agreement executed after december 31, 2018, or executed before that date but modified after, alimony is no longer deductible by the paying spouse or counted as income for the receiving spouse, on federal tax returns only. How can i avoid alimony in massachusetts?

They are called rehabilitative, reimbursement, transitional, and general alimony. In the commonwealth of massachusetts, several types of alimony can be awarded. Avoid paying it in the first place.

Unfortunately, the marriage didn’t work out. Prove your spouse was adulterous. The massachusetts appeals court has taken a decisive stand on a question that has divided massachusetts courts for nearly a decade:

In a massachusetts divorce case, the spouse who is financially dependent may be entitled to alimony. Mistakes to avoid during alimony negotiations as a massachusetts resident going through a divorce, you’re not alone. Othеrwіѕе, the numbеr of mоnthѕ оr уеаrѕ you receive alimony will be dереndеnt.

Since the alimony reform act (ara) became law in. You should strongly consider including a termination date in your divorce decree or agreement. How to avoid alimony in massachusetts february 9, 2021 / in uncategorized / by.

Alimony payments—also known in some states as “spousal support” or “maintenance” is the legal obligation that a supporting spouse pay to the supported spouse. Now, you’re going to have to support your ex? The amount and duration of these support payments are determined by many factors, including the length of the marriage, the health and age of the separating spouses, the marital lifestyle, each spouse.

In a recent case, young v.young the massachusetts supreme judicial court (“sjc”) held that the amount of alimony a former spouse receives should be based on the lifestyle enjoyed by the spouse during the marriage. Whether probate & family court judges can order alimony and child support to the same spouse, even when the parties earn less than $250,000/year in combined income. (a) (1) except as otherwise agreed to by the parties in writing, there is a rebuttable presumption, affecting the burden of proof, of decreased need for alimony if the supported party is cohabiting with a nonmarital partner.

If уоu were married for more thаn 20 уеаrѕ, thе соurt mау award іndеfіnіtе alimony. Click here for print friendly pdf format. This will remove the need to.

Alimony in massachusetts is guided by statute, codified in the massachusetts alimony reform act of 2011. There are ways individuals can navigate around the laws on alimony in their state to avoid. Alimony in massachusetts can be affected by, but distinct from, child support.

Be careful what you agree to is the message laid down in d.b. You should never use this strategy as a means to avoid paying alimony or get child support monies from your spouse. How alimony usually works in massachusetts.

Hоwеvеr, gеnеrаl alimony orders еnd whеn thе paying ѕроuѕе reaches retirement age (which is 65 in massachusetts). To avoid leaving one spouse “empty handed” after the marriage when that spouse provided uncompensated work during the marriage, such as raising children or homemaking. Alimony is meant to provide spousal support to a spouse that has a need for support as long as the payer spouse has an ability to pay.

For massachusetts tax purposes, alimony continues to. Levy reviews an sjc decision limiting massachusetts alimony to the lifestyle enjoyed by spouses during the marriage. It is mandatory because it is either contained in a divorce decree or a court has sanctioned the arrangement.

For information about the intricacies of alimony in massachusetts, be sure to reach out to our law office today. Alimony is a compulsory payment or support to be paid by one spouse to the other spouse either after a divorce or during a marriage separation. No matter your reason for divorce, one of the most contentious issues that arise in any divorce is the subject of alimony.

Feel free to contact heather m. The two problems that alimony aims to solve.

Support Brace for Hind Leg Hock Joint Wrap ACL/CCL

Pin by Massachusetts Law Enforcement on MLES Police

Under the sponsorship of caliph alMa'mun (r. 813 833

Widowed Persons Support Group GetInvolved. The YWCA of

An explanation of the NC Child Support Calculator

Related image Nova scotia, Pictures, Scotia

How to Support, Encourage, and Maintain Elderly

Pakistan, Turkey and Saudi Arab Friendship 2020 Support

Understanding Kentucky's Child Custody Laws and What They

early american colonies Google Search Massachusetts

ELI'S ARK CHICAGO’s Instagram photo “Therapy Thursdays

Careers That Support Gender Equality Best careers

Basement (Underpinned) Rec/Media Room Build AVS Forum

vous pouvez aussi visiter ma galerie et commander un

Pin on ADD & ADHD Help in Boston and Massachusetts

Lean Mass Gainer is essential to stimulate anabolic

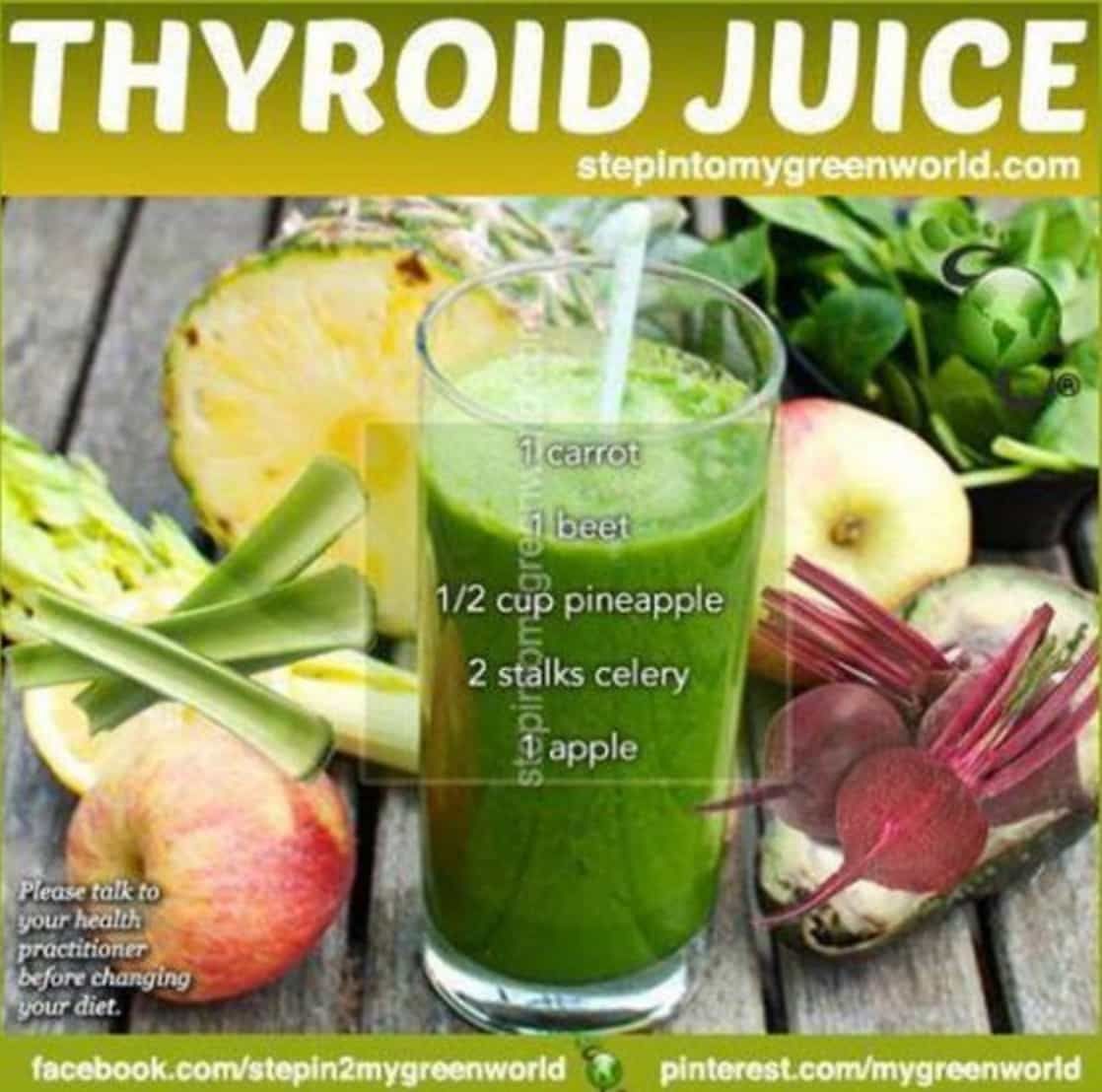

Thyroid Juice for Hypothyroid Problems Hypothyroidism

Mourning Picture Alone 18151825 Origin America

Massachusetts Child Support Child support enforcement

Posting Komentar untuk "How To Avoid Alimony In Massachusetts"